Tariff Shock & Inflation Risk: How U.S. Trade Policies Are Reshaping the Foundation of the Economy in 2025

The year 2025 is redefining how the world views American trade. After decades of globalization and free-market expansion, the United States has shifted toward a protectionist economic model, with new tariffs and supply-chain policies that are reshaping global commerce.

While these policies aim to strengthen domestic manufacturing and reduce dependency on China, they’ve also introduced a new challenge: tariff-driven inflation.

This “tariff shock” is rippling through every layer of the economy — from corporate supply chains to grocery store prices — forcing businesses and consumers to adapt to a more complex, cost-sensitive world.

⚙️ Understanding the 2025 Trade Policy Shift

In recent years, the U.S. government has embraced an aggressive stance toward economic security. This approach is defined by strategic tariffs, industrial subsidies, and trade realignment aimed at promoting national self-reliance.

1. The Return of Industrial Policy

After decades of offshoring, Washington is now using trade policy as a tool to rebuild critical industries like semiconductors, green energy, and defense manufacturing.

Programs under the CHIPS and Science Act and the Inflation Reduction Act (IRA) have poured hundreds of billions of dollars into domestic production, especially in states like Arizona, Texas, and Ohio.

However, these incentives come at a cost: they are paired with tariffs on imported components, especially from Asia, to protect U.S. producers.

2. Tariffs as a Tool of Diplomacy

Trade tariffs have evolved beyond simple economic tools — they’re now part of geopolitical strategy.

In 2025, the U.S. imposed:

-

25% tariffs on Chinese electric vehicles (EVs)

-

18% tariffs on solar panel components

-

15% tariffs on certain European steel and aluminum imports

These measures aim to reduce dependency and encourage friend-shoring — building trade networks with politically aligned nations.

📊 The Economic Ripple: How Tariffs Feed Inflation

While trade protection can strengthen domestic industries, it often leads to higher consumer prices.

1. Cost Pass-Through Effect

When import costs rise, companies pass those costs on to consumers. For example, tariffs on Chinese goods have increased input costs for U.S. manufacturers by up to 12%, according to the Peterson Institute for International Economics.

This affects not only finished products like electronics or autos but also intermediate goods — materials and components used across industries.

2. Supply Chain Reconfiguration

Companies are shifting production to “friendlier” countries like Mexico, Vietnam, and India. But this realignment takes time, often leading to short-term inefficiencies and higher logistics costs.

The global supply chain has become fragmented, with longer delivery times and less price stability.

3. Energy and Commodity Pressure

Trade tensions have also spilled over into commodity markets. Tariffs on metals, rare earths, and energy technologies have raised prices for industries dependent on clean energy and infrastructure materials.

The result: even as headline inflation cools, core inflation remains sticky, especially in goods linked to international supply chains.

🏭 Winners and Losers: Who Benefits from Tariff Shock?

Every economic shift creates winners and losers — and tariff policy is no exception.

✅ Winners

-

U.S. Manufacturers – Companies producing domestically benefit from reduced competition and subsidies.

-

Energy and Tech Firms – Green energy producers and semiconductor firms receive federal support and tax credits.

-

Strategic Allies – Countries like Mexico and Canada gain from supply-chain relocation under the USMCA framework.

❌ Losers

-

Import-Dependent Retailers – Brands relying on cheap imports face shrinking profit margins.

-

Consumers – Higher costs of everyday goods reduce purchasing power.

-

Small Businesses – They lack the capital to reconfigure supply chains or absorb rising costs.

For example, U.S. apparel retailers — many of which rely heavily on Asian suppliers — have seen price increases of 8–15% on imported inventory, forcing them to raise consumer prices or reduce product variety.

💵 The Consumer Perspective: Tariffs Meet Inflation

For the average American, tariffs may seem distant — a policy issue for politicians and economists. But the impact is real and visible in daily life.

1. Higher Prices at Checkout

Tariffs on imported goods have led to price hikes on electronics, clothing, and household goods. Even products labeled “Made in the USA” often rely on imported components, amplifying the effect.

A 2025 report by Moody’s Analytics estimates that tariffs add 0.6 to 0.9 percentage points to annual inflation.

2. Wage vs. Cost Imbalance

Although nominal wages have risen, real wages (adjusted for inflation) are struggling to keep pace. Consumers are saving less and using credit cards more — pushing household debt to a record $18.2 trillion in Q3 2025, according to the New York Fed.

3. Consumer Confidence Erosion

The University of Michigan’s Consumer Sentiment Index fell 8% in mid-2025, reflecting uncertainty about job stability and price increases.

Even as GDP growth remains steady, Americans feel poorer — a psychological effect that can dampen spending momentum.

🌎 Global Impact: Trade Allies and Tensions

America’s trade transformation doesn’t happen in isolation. Its ripple effects extend across the global economy.

1. The Rise of “Friend-Shoring”

The U.S. is actively shifting supply chains toward allied nations — Mexico, Canada, South Korea, and India are major beneficiaries.

Foreign direct investment (FDI) into Mexico, for example, hit a record $44 billion in 2024, largely from U.S. firms.

2. China’s Countermoves

China, facing reduced U.S. demand, has deepened trade ties with Latin America, Africa, and Southeast Asia.

However, reduced Chinese exports to the U.S. have slowed China’s manufacturing sector, affecting global supply chains for everything from solar panels to batteries.

3. Europe’s Dilemma

The European Union faces a strategic choice: align with U.S. trade policy or maintain open relations with China. Tariffs on European metals and cars have already strained transatlantic relations.

🧩 Business Adaptation: How Companies Are Surviving the Shift

U.S. corporations are finding innovative ways to mitigate tariff risk.

1. Localizing Supply Chains

Companies are investing in domestic production and regional sourcing.

Ford, for instance, announced a $3.5 billion expansion of its Michigan battery plant to qualify for U.S. green subsidies and avoid import tariffs.

2. Automation and AI Integration

To offset higher labor and input costs, many manufacturers are accelerating automation investments.

According to Deloitte, U.S. industrial automation spending grew 24% year-over-year in 2025, driven by AI-based process optimization.

3. Strategic Pricing and Brand Premiums

Some firms are passing costs to consumers by repositioning products as “premium” or “sustainable,” turning price increases into perceived value upgrades.

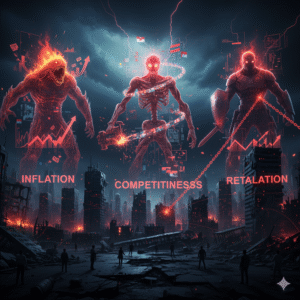

📉 The Long-Term Risks: Inflation, Competitiveness, and Retaliation

Tariff policy is a double-edged sword. While it strengthens certain sectors, it also creates structural risks.

1. Persistent Inflation

As tariffs continue to push costs upward, inflation could remain above the Federal Reserve’s 2% target — limiting room for interest rate cuts and keeping borrowing expensive.

2. Reduced Global Competitiveness

Protectionism can weaken export industries. If other nations retaliate with their own tariffs, American exporters face reduced global market share.

3. Innovation Slowdown

When companies are shielded from competition, innovation may stagnate. Economists warn that excessive protection can create inefficiency — the opposite of what the policy intends.

🏛️ The Policy Dilemma: Balancing Security and Affordability

The Biden administration (and likely its successors) face a fundamental question:

How can the U.S. secure its economy without sacrificing affordability?

Several proposals are on the table:

-

Dynamic tariff systems that adjust rates based on inflation levels.

-

Expanded tax credits for small businesses adapting to supply chain shifts.

-

Enhanced consumer subsidies to offset higher prices for essentials.

The challenge lies in balancing national security interests with the real economic pain felt by average households.

🔮 Outlook for 2026 and Beyond

Economists expect the U.S. to continue a selective decoupling strategy from China through 2026, focusing on key sectors like EVs, AI hardware, and defense.

However, the pressure to manage inflation will likely push policymakers to refine their approach — perhaps combining tariffs with targeted fiscal easing.

Businesses that adapt early — through automation, local sourcing, and pricing innovation — will emerge stronger in the new trade era.