Mortgage Rate Fluctuations and Their Impact on U.S. Real Estate Investments in 2025

Mortgage rates are a cornerstone of the U.S. real estate market, directly influencing home affordability, investor returns, and market liquidity. In 2025, fluctuating interest rates are reshaping strategies for both institutional and retail real estate investors.

This article provides an in-depth look at how mortgage rate changes affect U.S. real estate investments, identifies risk and opportunity zones, and offers actionable strategies to navigate the evolving landscape.

1. Current Mortgage Rate Trends in 2025

After a period of historical highs in 2022–2024, mortgage rates are stabilizing in 2025:

-

30-Year Fixed Rates: Approximately 6.8–7.0%

-

15-Year Fixed Rates: Approximately 6.1–6.4%

-

Adjustable-Rate Mortgages (ARMs): Around 5.5–6.0%

This stabilization follows a period of aggressive Federal Reserve rate hikes intended to curb inflation. While rates remain elevated compared to pre-2022 levels, many investors view this as a new normal and are adjusting long-term investment strategies accordingly.

2. How Mortgage Rates Affect Homebuyers and Investors

Mortgage rates influence the cost of borrowing, which impacts affordability, monthly payments, and investment yield.

a) For Homebuyers

Higher rates reduce the amount buyers can borrow, lowering home purchasing power. This can temporarily slow home sales but also moderate excessive price appreciation, preventing speculative bubbles.

b) For Real Estate Investors

Rates affect:

-

Cash Flow: Higher financing costs reduce monthly net income.

-

Property Valuation: Cap rates may adjust to reflect higher borrowing costs.

-

Financing Strategies: Investors may favor longer-term fixed-rate loans or explore alternative financing such as private credit or crowdfunding platforms.

3. Historical Perspective: Rate Fluctuations and Market Impact

2008 Financial Crisis

Mortgage rate spikes combined with subprime lending contributed to a housing market collapse, emphasizing the need for prudent financing strategies.

2020 Pandemic Response

The Fed slashed rates to historic lows (around 3%) to stimulate the economy, leading to a surge in homebuying and refinancing. Investors who timed acquisitions during low-rate periods enjoyed significant gains.

Historical patterns show that rate changes directly influence investor behavior and market momentum.

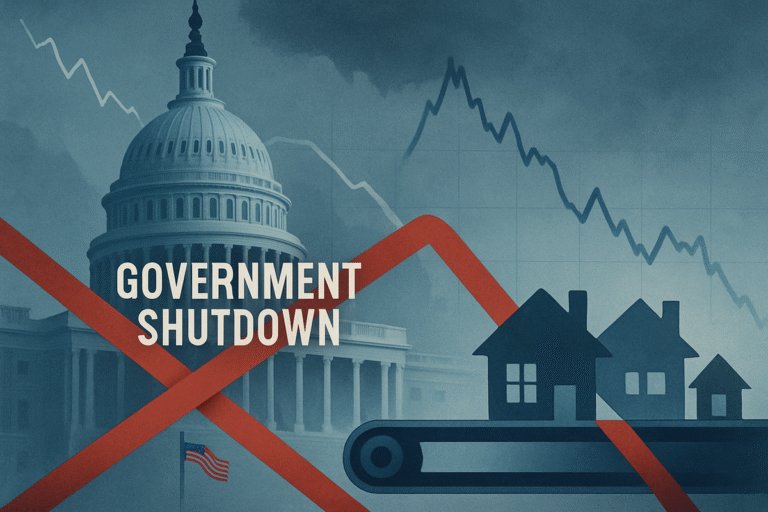

4. Key Factors Driving Mortgage Rate Volatility

Several elements are shaping mortgage rate fluctuations in 2025:

-

Federal Reserve Policy: The Fed’s decisions on benchmark rates influence long-term mortgage yields.

-

Inflation: Persistent inflation pressures maintain rates higher than historical averages.

-

Housing Supply and Demand: Tight inventory in certain metros supports sustained prices, indirectly affecting interest spreads.

-

Global Economic Trends: Geopolitical risks and international capital flows impact U.S. Treasury yields, which correlate with mortgage rates.

5. Impact on Different Real Estate Segments

a) Single-Family Homes

Higher mortgage rates reduce affordability for first-time buyers, slowing transaction volumes. However, experienced investors may acquire discounted or foreclosed properties, creating opportunity.

b) Multifamily Properties

Rental demand typically rises when homebuying becomes more expensive, benefiting apartment and multifamily investors through increased occupancy rates and higher rental yields.

c) Commercial Real Estate

Office and retail properties may experience pressure from higher financing costs. Investors often adjust cap rates and prioritize income-stable tenants.

d) Industrial and Logistics

E-commerce growth maintains demand for warehouses and distribution centers, mitigating interest rate sensitivity.

6. Strategies for Investors During Rate Fluctuations

a) Locking in Fixed-Rate Mortgages

Securing long-term fixed rates provides predictability in cash flow and shields against future hikes.

b) Refinancing Opportunistically

Investors should monitor rate trends and refinance when favorable conditions arise, especially for properties with short-term adjustable loans.

c) Diversifying Financing Sources

Alternative financing, such as private equity loans, hard money lenders, or crowdfunding platforms, can mitigate exposure to rising traditional mortgage rates.

d) Focus on Cash Flow and Yield

Prioritize investments with strong rental income, reducing reliance on speculative appreciation.

7. Rate Fluctuations and Investment Timing

Understanding rate cycles allows investors to strategically time acquisitions and refinancing:

-

During Rising Rates: Focus on cash-flow-positive properties, reduce leverage, and explore alternative financing.

-

During Falling Rates: Consider refinancing existing properties, acquiring high-potential assets, or leveraging ARMs for flexibility.

Timing is crucial, as even minor rate changes can significantly affect investment returns over 10–15 year horizons.

8. Real-Life Examples: Navigating 2025 Market Conditions

Case Study 1: Multifamily Acquisition in Raleigh

An investor acquired a 50-unit apartment complex in Raleigh, NC, during a rate plateau. By locking in a 30-year fixed mortgage at 6.9%, the property generates steady cash flow even amid potential rate increases.

Case Study 2: Industrial Property in Phoenix

A logistics investor financed a warehouse through a combination of private debt and traditional mortgage. Despite slightly higher borrowing costs, the property benefits from strong e-commerce demand, mitigating interest rate risk.

Case Study 3: Single-Family Rental Portfolio

A portfolio of suburban single-family homes in Tampa, FL, saw rental demand surge as mortgage rates constrained homeownership, demonstrating how rate fluctuations can create opportunity in rental markets.

9. Mortgage Rate Predictions for Late 2025

Analysts project rates may stabilize or slightly decline, depending on inflation trends and economic growth. Investors should prepare for:

-

Potential rate volatility in Q4 2025

-

Opportunities in refinancing and strategic acquisitions

-

Focus on cash-flow resilient assets

By aligning investments with expected rate trends, investors can maximize returns while managing risk.